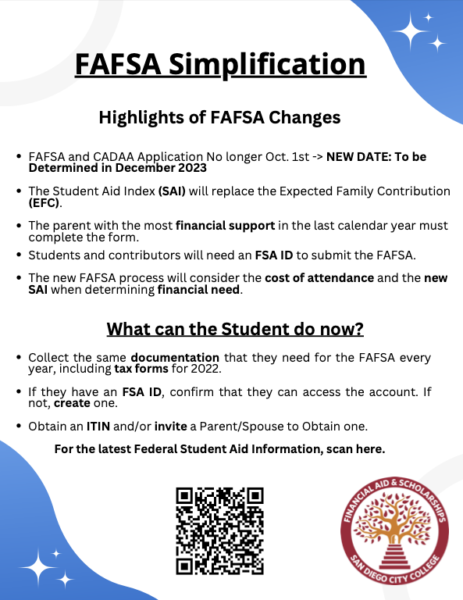

Financial aid and scholarship director Wendy Wang sent an email to San Diego City College on Sept. 29, sharing an attachment highlighting the changes that accompany the new FAFSA application.

With those changes expected in December, City Times sought out Wang to obtain more information regarding the changes.

Like students, the financial aid office is waiting for more information.

In the meantime, Wang suggested students prepare their tax returns.

FAFSA will be retrieving information from the IRS directly as part of its eligibility criteria, according to Wang.

Once the tax return is ready, she said, students can apply.

The new date for the 2024-2025 FAFSA application will be determined at some point in December.

Here’s what City Times knows about the new FAFSA simplification.

FAFSA and the California Dream Act Application have been updated, to open December 2023

According to the federal student aid outreach YouTube Channel, this application opening date in December will only take place this year.

The federal deadline for the 2024-2025 application will be June 30, 2025.

The Expected Family Contribution (EFC) will be replaced by the Student Aid Index (SAI)

SAI is a number used to determine eligibility for need-based aid calculated using information that students and contributors provide on the FAFSA form, according to the FSA Outreach YouTube video, “FAFSA Changes: An Overview.”

The parent with the most financial support in the last calendar year must complete the form

Whichever parent provides the greatest amount of student’s financial support will be required to be a contributor on the FAFSA application.

Independent students will not require contributors, according to FSA Outreach.

Students, contributors need an FSA ID to submit the FAFSA

A contributor is someone who is asked by FAFSA to provide information on the application.

This will be anyone that is considered financial support for a student, and will typically be the student, the student’s spouse, a biological or adoptive parent, or that parent’s spouse, according to FSA Outreach.

A student’s or parent’s answers on the FAFSA form will determine who, if anyone, contributes.

Contributors will be asked to provide personal and financial information of their own and are not responsible for the student’s educational cost. According to FSA Outreach, the new FAFSA process will consider the cost of attendance and the new SAI when determining financial need.

Contributors will need their own FSA ID to provide financial information

An FSA ID can be made on the federal student aid website. A social security number is not required to make an account, according to FSA Outreach.

The new FAFSA process will consider the cost of attendance and the new SAI when determining financial need

The new need formula will equal the cost of attendance, minus SAI, minus other financial assistance.

Obtain an ITIN and/or invite a parent/spouse to obtain one

According to FSA Outreach, all students and contributors must provide consent to their federal tax information being transferred into the FAFSA form via the IRS.

If a student or contributor doesn’t have a social security number, didn’t file taxes or filed taxes outside of the U.S. they will still need to provide consent, according to FSA Outreach.