When 58-year-old San Diego City College student Sara Tiumalu found out student loans were put on hold due to the COVID-19 pandemic, she was relieved.

“Thank you, Lord, hallelujah,” Tiumalu remembered saying.

But with news that payments resumed in October, her reaction shifted.

“Pysche,” she said. “Like, what?”

The temporary suspension of federal student loan payments and the waiving of interest officially expired as of October 2023, according to the Federal Student Aid office of the U.S. Department of Education.

The Department of Education originally implemented this relief measure in response to the COVID-19 pandemic to ease the financial burden on borrowers.

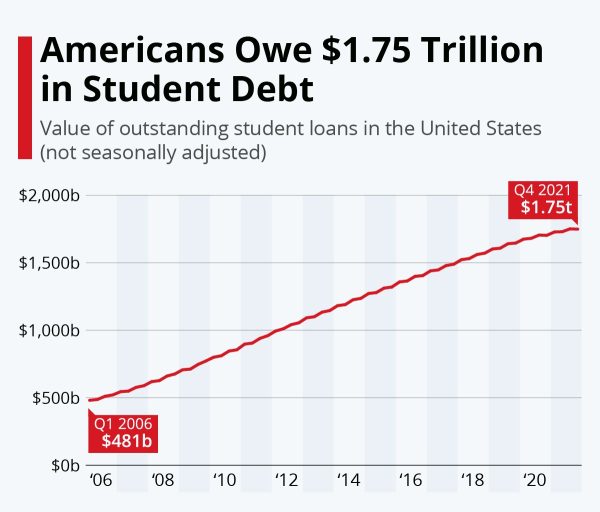

Currently, there are 45 million borrowers in the U.S. with student loan debt and a balance totaling over 1.77 trillion, according to the Federal Reserve.

California comes with the highest amount of debt totaling $141.8 billion

While interest started accruing on Sept. 1, the first payments were not due until Oct. 1.

For City College students, this change could significantly impact their finances and repayment strategies.

Now that payments and interest have resumed, students must plan and adjust their budgets accordingly, campus financial aid officials said.

Because of the financial shock, Tiumalu indicated it’s best for the government to extend the COVID debt relief and forgive the debt altogether.

“When you told me I didn’t have to pay, it took a weight off my shoulder. Now you’re coming back at me?” Tiumalu said. “You can’t come back and say, ‘nevermind.’”

City College partners with the nonprofit Educational Credit Management Corporation (ECMC), according to Director of Financial Aid Wendy Wang.

The credit organization connects with students who are about to start entering repayment and acts as “a middleman to help them decide which (repayment) plan is best for them,” Wang said.

According to Wang, if you are a City College student who has student loans and is not currently on a payment plan, ECMC will reach out to you to help you find the best plan for your financial situation.

The financial aid director emphasized there is nothing to be ashamed of when it comes to paying back loans.

Manageable payment plans are available and City College has resources to help students find the right plan for their specific financial situation, she said.

Wang stressed there are several specific options available to each student and it’s best to find the right plan rather than to take no action at all.

Students can stay informed about the latest updates on their student loans with the official Federal Student Aid website, which provides updated information regarding loan repayment, interest rates and any potential extensions of relief measures.

Additionally, reaching out to the City College Financial Aid Office for personalized guidance and support can be beneficial to students.

Despite the resources available to assist students in resuming their student debt payments, Tiumalu suggests an alternative route.

“We don’t need extra, we need a solution. Not more problems,” Tiumalu said. “Can you just please understand? Everybody needs a break.”

The Financial Aid Office is open Monday-Thursday from 8 a.m. to 6 p.m., and Friday from 8 a.m. to 1 p.m.